Pass Me a Pen?

- Mark Lipton

- Jul 26, 2023

- 2 min read

Updated: Jul 26, 2023

Among the most abiding memories of life as the son of a paint dealer, was the wad of bills omnipresent in my father’s front pant pocket.

Billy Lipton, did not do cashless!

But fast forward 50-years and cash transactions have all but disappeared from American commerce, with the events of the pandemic only accelerating that trend. Cash withdrawals from ATM’s have decreased more than 10%, in each of the last four years!

Take a Swipe at Me?

For some independent retailers credit card processing fees can be their third-largest expense behind salaries and rent. And while I don’t think the fees are that high on the list of paint dealer expenses, they’re likely in the top-five!

It’s the Visa, Mastercard and American Express monopoly which allows small businesses to be fleeced while collecting their money, those three companies account for nearly 100% of credit cards issued in the United States.

That monopoly allowing those banks to charge usurious fees for each transaction.

Usurious, because technology has driven down the bank's costs to process each transaction from $.08, down to $.04!

And THE corporate pickpocketing is a uniquely American problem. Since 2015, interchange rates in the European Union and China have been capped, at .20% for debit card transactions and .30% for credit.

One tenth the average discount rate retailers pay in the U.S.!

The Credit Card Competition Act of 2023 looks to take aim at the issue. If signed into law, the bill mandates that credit and debit cards issuers with assets in excess of $100 billion be required to offer retailers at-least two network choices to process their transactions.

THE competition estimated to save retailers more than $16 billion per-year.

And don’t worry about the banks, they won’t miss it!

Rise Up!

Working to aid the bill’s passage has been Small Business Rising, a coalition of retailer trade organizations representing more than 250,000 independent retailers across the United States.

Amongst those 250,000 are the 40,000 independent paint and hardware retailers of the North American Hardware and Paint Association; the NHPA recently adding their numbers to those advocating for CCCA 2023's passage.

As the Finance Committee of the United States Senate takes up CCCA it may seem that there’s little reason for retailers to be hopeful. THE banks spent $65 million lobbying against the Credit Card Competition Act of 2022, so why expect them to give back that $16 billion without the same fight?

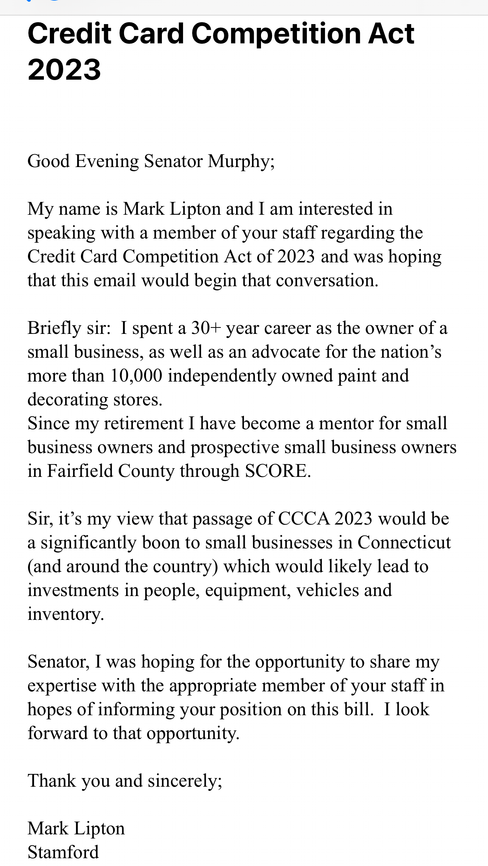

It’s From Mark, Again!

But this year could be different. With stories of corporate greed pervasive in the news and on social media, both political parties may be peaked by an opportunity to return $16 billion to 250,000 family-owned and small businesses.

And if THE senators aren't aware that the banks won’t miss the money, they will be soon!